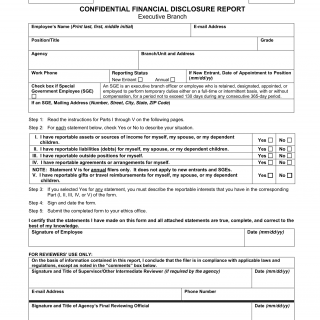

OGE 450. Confidential Financial Disclosure Report - Executive Branch

The OGE 450 Confidential Financial Disclosure Report is a form used by the Executive Branch of the US Government to collect financial information from high-level government officials. The primary purpose of this form is to ensure that government officials are not engaging in unethical or illegal financial activities that could compromise their ability to serve the public.

The form consists of several parts, including a cover sheet, a reporting section, and a certification section. The reporting section requires the disclosure of financial information such as income, assets, liabilities, and gifts. There are also several important fields that must be completed, including the filer's name, position, and agency.

The parties involved in the completion of this form are the government officials required to disclose their financial information and the Office of Government Ethics, which receives and reviews the forms.

When compiling the form, filers will need to provide detailed financial information, including sources of income, investments, and debts. Additionally, filers may be required to attach additional documents such as tax returns, bank statements, and investment portfolios.

Application examples of this form include high-level government officials such as Cabinet members, White House staff, and other high-ranking officials.

The benefits of this form are that it helps to ensure that government officials are not engaging in unethical or illegal financial activities, which could compromise their ability to serve the public. However, the challenges and risks involved in completing this form include the potential for financial information to be leaked or used for nefarious purposes.

Related forms include the SF 278 Public Financial Disclosure Report, which is used by federal officials to disclose their financial interests to the public. An alternative form is the OGE Form 278e, which is used by certain officials to disclose financial interests in privately held entities.

The completion of this form can impact the future of the participants by potentially affecting their ability to serve in government positions if financial improprieties are discovered.

The form is submitted to the Office of Government Ethics and is stored in a secure database.