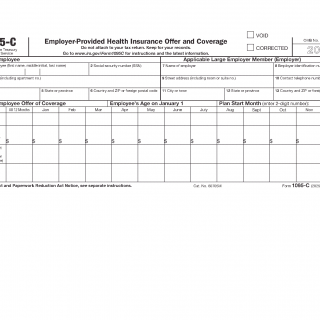

IRS Form 1095-C. Employer-Provided Health Insurance Offer and Coverage

IRS Form 1095-C. Employer-Provided Health Insurance Offer and Coverage

IRS Form 1095-C is an informational document used to report health insurance coverage offers and, in certain cases, actual coverage provided by applicable large employers. The form reflects employer reporting obligations under federal health coverage rules and documents how employer-sponsored coverage was recorded during the year.

Official role of Form 1095-C

Form 1095-C exists to support the administration of employer shared responsibility provisions. It distinguishes employer-reported coverage offers and coverage from Marketplace coverage and other non-Marketplace coverage, which are documented under different forms and reporting systems.

Who issues Form 1095-C

The form is issued by an Applicable Large Employer that is subject to employer health coverage reporting requirements. Employers generate and furnish the form to employees based on employment status and coverage reporting rules. The employee does not prepare or modify the form.

What information the form records

Form 1095-C records whether health coverage was offered, the type of coverage offer, the months to which the offer applied, and, for self-insured plans, which individuals were actually covered. The form may report offers of coverage even when coverage was declined.

How the form functions within the reporting system

The employer reports the same information shown on Form 1095-C directly to the Internal Revenue Service. The form supports system-level evaluation of employer compliance with health coverage requirements and helps determine how employer coverage interacts with other parts of the health coverage framework.

Relationship to tax filing

Form 1095-C is not attached to a tax return and is not required to be submitted when filing taxes. It does not calculate the premium tax credit and does not by itself determine a refund or balance due. Its role is informational and administrative rather than transactional.

What the form does not require

Form 1095-C does not require the employee to take action, does not create a filing obligation, and does not impose a penalty by itself. Receiving the form reflects normal employer reporting activity.

Relation to other Forms 1095

Form 1095-C is used only for employer-reported coverage. Coverage obtained through a Health Insurance Marketplace is reported on Form 1095-A, while coverage provided by insurers, government programs, or certain plan sponsors is reported on Form 1095-B. Each form corresponds to a separate coverage reporting system.

For a practical, process-based explanation of why this form is issued and how it appears in real situations, see Form 1095-C practical overview.