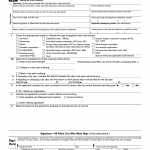

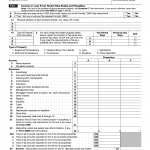

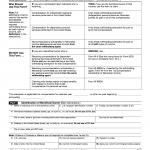

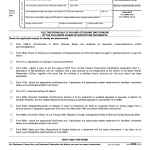

IRS Form 941 Schedule B. Report of Tax Liability for Semiweekly Schedule Depositors

IRS Form 941 Schedule B, also known as the "Report of Tax Liability for Semiweekly Schedule Depositors," is an essential document used by employers to report their tax liabilities for Social Security, Medicare, and federal income taxes withheld from employee wages. This form is specifically designed for semiweekly schedule depositors, which are employers who have accumulated $100,000 or more in tax liabilities on any given day during a monthly or semiweekly deposit period.