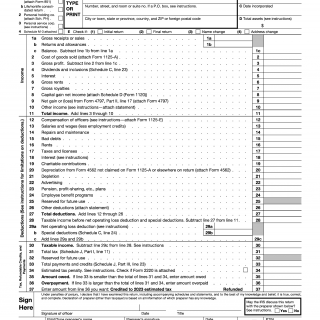

IRS Form 1120. U.S. Corporation Income Tax Return

Form 1120, U.S. Corporation Income Tax Return, is a tax form used by corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS).

The form consists of several parts, including a summary page, schedules for specific deductions and credits, and a signature page. Important fields on the form include the corporation's name, address, and identification number, as well as information about the corporation's income and expenses.

The parties involved in this form are the corporation and the IRS. It is important to consider that corporations must file this form annually and that the information provided must be accurate and complete.

Data required when compiling the form includes the corporation's income and expenses, as well as any deductions and credits that they are eligible for. Additionally, corporations may need to attach supporting documents, such as financial statements and schedules for specific deductions.

An application example of this form is when a corporation files their annual tax return with the IRS. The form is used to report the corporation's income and expenses for the previous year, and to calculate the amount of tax owed or refund due.

Strengths of this form include providing a clear and organized way for corporations to report their income and expenses, as well as ensuring compliance with tax laws. Weaknesses may include the complexity of the form and the potential for errors or omissions that could lead to penalties or fines.

Alternative forms to Form 1120 include Form 1120S, U.S. Income Tax Return for an S Corporation, and Form 1065, U.S. Return of Partnership Income. These forms are used by different types of businesses and have different requirements for filing.

Compiling and submitting Form 1120 correctly can have a significant impact on the future of the corporation, as it ensures compliance with tax laws and can affect their financial statements. The form is typically submitted electronically or by mail, and a copy should be stored for record-keeping purposes.