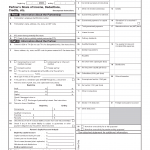

IRS Form 8822: Change of Address for Individuals

Form 8822 is used to notify the IRS when an individual changes their home mailing address. This form ensures that IRS correspondence is sent to the correct address after a move or other address change.

Form 8822 applies only to personal addresses. It does not update business addresses or information related to entities that use an Employer Identification Number (EIN).

What Is Form 8822 Used For?

Form 8822 is used to report a change in an individual’s home mailing address with the IRS. This includes address changes related to: