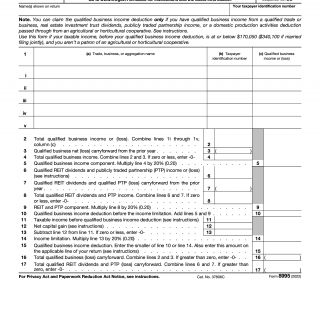

IRS Form 8995. Qualified Business Income Deduction Simplified Computation

Form 8995, Qualified Business Income Deduction Simplified Computation, is a form used by taxpayers who have qualified business income and are eligible for a deduction on their income taxes.

This form consists of several parts, including personal information about the taxpayer, details about the business income, and calculation of the deduction. Important fields to consider when compiling/filling out the form include the taxpayer's name, social security number or taxpayer identification number, and the amount of qualified business income.

The parties involved in the completion of this form include the taxpayer and the Internal Revenue Service (IRS). It is important to note that any false statements made on the form can result in legal issues.

When compiling/filling out the form, the taxpayer will need to provide personal information such as their name, social security number or taxpayer identification number, and the amount of qualified business income. The form also requires the taxpayer to calculate the deduction based on specific calculations outlined by the IRS.

Examples of when this form may be needed include when a taxpayer has qualified business income and is eligible for the deduction. It is important to note that the eligibility for this deduction is subject to certain limitations and requirements.

Strengths of this form include the fact that it simplifies the process of calculating the qualified business income deduction, making it easier for taxpayers to claim the deduction. Weaknesses include the potential for errors on the form, which can result in legal issues.

Alternative forms related to this include Form 8995-A, which is used for taxpayers who have qualified business income and are not eligible for the simplified calculation.

The completion of this form can have a significant impact on the future of the taxpayer, as the deduction can result in significant tax savings. The form is submitted to the IRS and is stored in their database.

In summary, Form 8995, Qualified Business Income Deduction Simplified Computation, is a critical document for taxpayers who have qualified business income and are eligible for the deduction. It is important to accurately complete the form to avoid legal issues and to follow the necessary steps to claim the deduction.