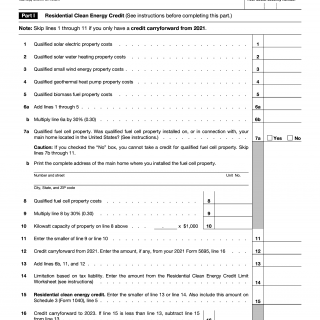

IRS Form 5695. Residential Energy Credits

Form 5695, Residential Energy Credits, is a legal document used by taxpayers who have made energy-efficient improvements to their home or purchased certain energy-efficient products.

The main purpose of this form is to claim a credit for residential energy expenses, which can reduce the amount of tax owed to the IRS. The form consists of several parts, including fields for personal information, information about the property, and details of the energy-efficient improvements made.

Important fields on the form include the taxpayer's name, address, social security number, and the amount of the residential energy credit being claimed. The parties involved in filling out this form are the taxpayer who made the energy-efficient improvements and the IRS who will review the application.

It is important to consider accuracy when compiling and filling out this form as any incorrect or false information could result in a denial of the credit or even penalties and fines.

When compiling/filling out the form, taxpayers will need to provide information about their home and the energy-efficient improvements made, including the type of improvement, the date it was made, and the cost. Additional documents that must be attached to the form include receipts, invoices, and proof of purchase for the energy-efficient products or services.

One example of when this form might be used is when a taxpayer purchases and installs solar panels on their home. The form is used to claim a credit for the expense of the solar panels and reduce the amount of tax owed to the IRS.

Strengths of this form include its ability to incentivize taxpayers to make energy-efficient improvements to their homes and reduce their energy consumption. Weaknesses include the complexity of the form and the potential for errors or delays in the application process.

Related forms include Form 1040, which is the standard tax form used by individuals to file their tax returns, and Form 5695 (Residential Energy Credits), which is used to claim a credit for residential energy expenses.

The completed form is submitted to the IRS and is stored in their database for future reference. The form affects the future of participants by providing a credit for energy-efficient improvements made to their home, which can result in long-term cost savings and environmental benefits.