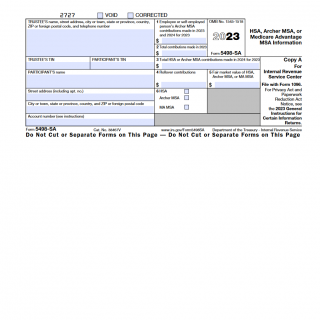

IRS Form 5498-SA. HSA, Archer MSA, or Medicare Advantage MSA Information

Form 5498-SA is a tax form used to report contributions made to a Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA. The form is typically filed by the trustee or custodian of the account and is sent to both the account holder and the Internal Revenue Service (IRS).

The form consists of several parts, including the account holder's identifying information, the account type, and the contributions made to the account during the tax year. It also includes information about the account balance at the end of the year and any distributions made from the account.

When compiling the form, it is important to have accurate records of all contributions and distributions made to the account during the tax year. The account holder may need to provide additional documentation, such as receipts or statements, to support the amounts reported on the form.

One application of Form 5498-SA is to help account holders track their contributions and distributions for tax purposes. By reporting this information to the IRS, the account holder can ensure that they are in compliance with tax laws and avoid penalties or fines.

Strengths of the form include its ability to help account holders manage their tax obligations related to HSAs, Archer MSAs, and Medicare Advantage MSAs. However, weaknesses may include the complexity of the form and the potential for errors if accurate records are not maintained.

Related forms include Form 1099-SA, which is used to report distributions made from an HSA, Archer MSA, or Medicare Advantage MSA. Alternative forms may include Schedule 1 of Form 1040, which is used to report additional income sources.

Overall, Form 5498-SA plays an important role in helping account holders manage their tax obligations and comply with IRS regulations. It is typically submitted to the IRS by the trustee or custodian of the account and should be kept on file by the account holder for at least three years.