Form E-595E. Streamlined Sales and Use Tax Certificate of Exemption (North Carolina)

The Form E-595E, also known as the Streamlined Sales and Use Tax Certificate of Exemption, is a document used in North Carolina to claim exemption from sales and use tax on eligible purchases.

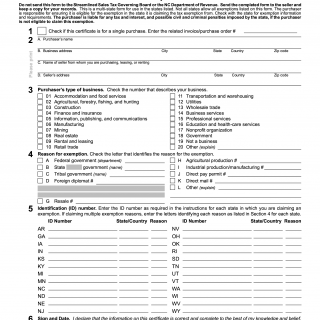

The form consists of two parts: the Certificate of Exemption and the Supporting Data Schedule. The Certificate of Exemption requires information about the purchaser, seller, reason for exemption, and signature. The Supporting Data Schedule requires additional information about the purchaser and the exempt purchase.

The parties involved are the purchaser and the seller. The purchaser must provide accurate and complete information when compiling the form, and the seller must keep a copy of the form for their records.

When compiling the form, the purchaser will need to provide their name, address, and tax identification number, as well as information about the exempt purchase, including the type of exemption and the amount of the purchase. Additional supporting documents, such as invoices or receipts, may need to be attached depending on the type of exemption claimed.

Some application examples include purchases of tangible personal property for resale, purchases of raw materials for manufacturing, and purchases of certain medical supplies.

Strengths of the form include its standardization across participating states in the Streamlined Sales and Use Tax Agreement, which simplifies compliance for businesses operating in multiple states. Weaknesses include the potential for errors or incomplete information, which could result in penalties or fines.

Alternative forms include state-specific exemption certificates, such as the Form ST-5 in Georgia or the Form ST-101 in New York.

Compiling the Form E-595E allows purchasers to claim exemption from sales and use tax on eligible purchases, resulting in potential savings for their business. The form is submitted to the seller at the time of purchase, and the seller is responsible for keeping a copy of the form for their records.

In conclusion, the Form E-595E is a crucial document for businesses in North Carolina to claim exemption from sales and use tax on eligible purchases. By providing accurate and complete information when compiling the form, businesses can potentially save money and simplify compliance with tax laws.