SUTEC Application. Sales and Use Tax Exemption Certificate Application (Maryland)

The Maryland SUTEC Application, also known as the Sales and Use Tax Exemption Certificate Application, is a form used by businesses to apply for sales and use tax exemption in the state of Maryland. The main purpose of the form is to claim exemption from sales and use tax on purchases made by the business that are intended for resale or are used in the production of goods for resale.

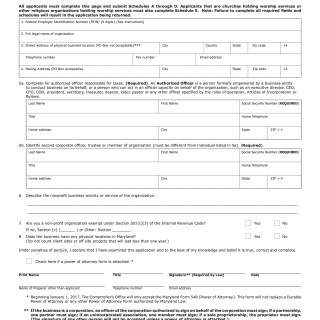

The Maryland SUTEC Application consists of two parts. Part 1 requires information about the business, including contact information, tax identification number, and the reason for the exemption. Part 2 requires a list of purchases for which the exemption is being claimed, including the date of purchase, name of vendor, description of the item, and the purchase price.

The important fields in the Maryland SUTEC Application include the business's name, tax identification number, and contact information. In addition, the reason for the exemption and the list of purchases for which the exemption is being claimed are also important fields.

The parties involved in the Maryland SUTEC Application are the business applying for the exemption and the Maryland Comptroller's Office, which reviews and approves the application.

When compiling the Maryland SUTEC Application, businesses will need to provide their tax identification number, contact information, and a description of the reason for the exemption. In addition, businesses will need to provide a list of purchases for which the exemption is being claimed, including the date of purchase, name of vendor, description of the item, and the purchase price. Businesses may need to attach additional documents to support their application for sales and use tax exemption, such as invoices, receipts, and other records of purchases for which the exemption is being claimed.

An example of when a business might use the Maryland SUTEC Application is if they purchase inventory to resell in their store. The business would use the SUTEC Application to claim exemption from sales and use tax on those purchases. Another use case is if a business purchases equipment or supplies to use in the production of goods for resale. The SUTEC Application would be used to claim exemption from sales and use tax on those purchases.

One strength of the Maryland SUTEC Application is that it provides businesses with a way to claim exemption from sales and use tax on purchases made for resale or for use in the production of goods for resale. One weakness is that businesses must provide detailed information about their purchases, which can be time-consuming and may require additional documentation.

An alternative form to the Maryland SUTEC Application is the Maryland Sales and Use Tax Return. This form is used to report sales and use tax owed to the state, rather than to claim exemption from the tax.

Once the Maryland SUTEC Application is approved, it will be stored by the Maryland Comptroller's Office for future reference. The form affects the future of the participants by allowing businesses to claim exemption from sales and use tax on eligible purchases, which can save them money and improve their bottom line. The form can be submitted online through the Maryland Comptroller's Office website, or it can be submitted by mail.