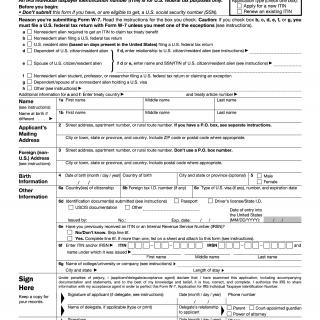

IRS Form W-7. Application for IRS Individual Taxpayer Identification Number

The Form W-7 is an official application for an Individual Taxpayer Identification Number (ITIN) issued by the Internal Revenue Service (IRS) of the United States. The ITIN is a tax processing number issued to individuals who are required to file tax returns but are not eligible for a Social Security Number (SSN).

The form consists of several parts, including personal information, identification documents, and other relevant details. Important fields to consider when compiling the form include the reason for applying, the applicant's foreign status, and the type of tax return the applicant will file.

When filling out the form, applicants will need to provide identification documents, such as a valid passport or national ID card, and proof of foreign status. Additional documents may be required depending on the reason for applying.

Examples of practice and use cases for the Form W-7 include foreign individuals who receive income from a U.S. source and are required to file a tax return, as well as non-resident aliens who own property or do business in the United States.

Strengths of the form include its clear instructions for completion and the ability for foreign individuals to comply with U.S. tax laws. However, weaknesses include the potential for confusion or errors when filling out the form, particularly for those unfamiliar with U.S. tax requirements.

Alternative forms and analogues may include the Form SS-5, which is used to apply for a Social Security Number, and the Form W-9, which is used to provide a Taxpayer Identification Number to companies who pay for services.

The Form W-7 can have a significant impact on the future of the applicants, as it enables them to comply with U.S. tax laws and receive tax refunds. The form is typically submitted to the IRS and stored in their database.

Overall, the Form W-7 is an important application for foreign individuals who are required to file tax returns in the United States and should be filled out with care and attention to detail.