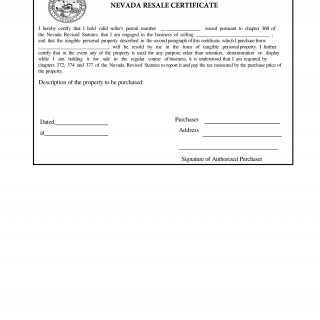

Resale Certificate (Neavada)

The Resale Certificate form is a crucial document for businesses in Nevada that hold a sales tax permit to purchase items that they will later resell without being charged tax. The main purpose of the form is to allow permit holders to avoid paying sales tax on items that are intended for resale.

The form consists of several important fields, including the name and address of the purchaser, sales tax permit number, and the reason for the exemption. The parties involved in this process are the purchaser and the seller. The purchaser must provide accurate and complete information when compiling the form, and the seller must keep a copy of the form for their records.

When compiling the form, the purchaser will need to provide their name, address, and sales tax permit number, as well as information about the exempt purchase, including the type of exemption and the amount of the purchase. Additional supporting documents, such as invoices or receipts, may need to be attached depending on the type of exemption claimed.

Application examples for this form include purchases of tangible personal property for resale, such as items for a retail store. The form is an important part of the purchasing process for permit holders, as it allows them to avoid paying sales tax on items that are intended for resale.

Strengths of the form include its simplicity and ease of use, as well as the potential for cost savings for businesses. Weaknesses include the potential for errors or incomplete information, which could result in penalties or fines.

Alternative forms for this purpose include state-specific exemption certificates, such as the Streamlined Sales and Use Tax Certificate of Exemption used in North Carolina. These forms serve a similar purpose but may have different fields and requirements.

The Resale Certificate form is an important tool for businesses in Nevada with sales tax permits to avoid paying sales tax on items intended for resale. By providing accurate and complete information when compiling the form, businesses can potentially save money and simplify compliance with tax laws. The form is submitted to the seller at the time of purchase, and the seller is responsible for keeping a copy of the form for their records.