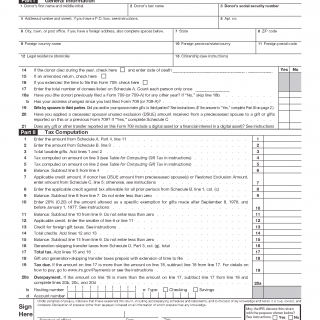

IRS Form 709. United States Gift (and Generation-Skipping Transfer) Tax Return

IRS Form 709 is the official federal tax return used to report taxable gifts and certain generation-skipping transfers made by an individual during a calendar year. The form is administered by the Internal Revenue Service and functions as the primary reporting mechanism for applying gift tax rules, lifetime exclusion amounts, and generation-skipping transfer tax provisions.

Official purpose of Form 709

Form 709 is used to report transfers of property by gift that are subject to federal gift tax rules, as well as transfers that may trigger generation-skipping transfer tax obligations. The form also serves as the mechanism for tracking the use of the lifetime gift and estate tax exclusion, including any applicable deceased spousal unused exclusion amount.

System context and role

Form 709 operates within the federal transfer tax system and is filed on an annual, calendar-year basis. Each year in which a reportable gift is made requires a separate Form 709. The form integrates multiple schedules to capture different categories of gifts, prior-period transfers, spousal elections, and generation-skipping calculations.

Structure of the form

The form consists of a main return and several attached schedules. Schedule A reports current-year gifts and classifies them by tax treatment. Schedule B tracks taxable gifts from prior periods. Schedule C documents deceased spousal unused exclusion amounts and related adjustments. Schedule D computes generation-skipping transfer tax and exemption allocations. Together, these sections establish the donor’s cumulative transfer tax position.

Official sources and updates

The content, structure, and filing requirements of Form 709 are defined by federal tax law and official Internal Revenue Service instructions. The form and its instructions may change when tax laws or reporting rules are updated, and the current version must always be used for the applicable tax year.

Related practical guidance

For practical explanations of when Form 709 is required, how the form is used in real filing scenarios, and how its sections relate to common gift situations, see the main guidance hub: Form 709 practical guide and usage overview.