IRS Form 211. Application for Award for Original Information

The Form 211 Application for Award for Original Information is a document used to report possible violations of federal securities laws. The main purpose of this form is to provide individuals with the opportunity to receive a monetary award for providing original information that leads to a successful enforcement action by the Securities and Exchange Commission (SEC).

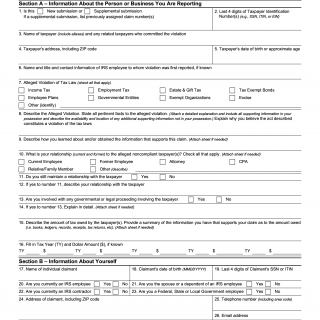

The form consists of several parts, including personal information about the individual providing the information, a detailed description of the potential violation, and any supporting documentation that may be available. Important fields to consider when filling out this form include providing accurate and detailed information, as well as ensuring that all information provided is truthful and not misleading.

The parties involved in the Form 211 Application for Award for Original Information include the individual providing the information and the SEC. It is important to note that the SEC keeps the identity of the individual providing the information confidential, unless disclosure is required by law.

When compiling/filling out the form, individuals will need to provide detailed information about the potential violation, including the date of the violation, the individuals or entities involved, and any supporting documentation that may be available. It is also important to include any personal information that may be relevant to the potential violation.

Additional documents that may need to be attached to the form include any supporting documentation, such as emails, financial statements, or other relevant information that may help support the claim.

Examples of application and use cases for the Form 211 Application for Award for Original Information include reporting insider trading, accounting fraud, or other violations of federal securities laws. The strengths of this form include providing individuals with a financial incentive to report potential violations, which may help to uncover fraudulent activity that may otherwise go unnoticed. However, weaknesses may include the potential for false or misleading information to be reported, which could lead to unnecessary investigations or legal action.

Alternative forms or analogues to the Form 211 Application for Award for Original Information may include whistleblower programs offered by other government agencies or private organizations. However, the key difference is that the SEC specifically focuses on violations of federal securities laws.

The future of participants who submit the Form 211 Application for Award for Original Information may be impacted positively, as they may receive a monetary award for their contributions to uncovering fraudulent activity. However, it is important to note that there may also be risks associated with submitting this form, including potential retaliation or negative consequences from the individuals or entities involved in the potential violation.

The Form 211 Application for Award for Original Information can be submitted online through the SEC's website, and is stored securely by the SEC for future reference.