IRS Form 1099-NEC. Nonemployee Compensation

The IRS Form 1099-NEC is a tax form used to report nonemployee compensation paid to independent contractors, freelancers, and other self-employed individuals. The main purpose of the form is to provide the IRS with information about payments made to non-employees, which must be reported on their tax returns.

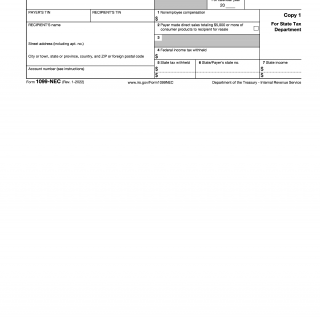

The form consists of several parts, including the payer's name, address, and taxpayer identification number (TIN), as well as the recipient's name, address, and TIN. Important fields include the amount of nonemployee compensation paid during the tax year, as well as any federal income tax withheld.

The parties involved in the form include the payer and the recipient of the nonemployee compensation. It is important to consider the accuracy and completeness of the information provided when writing the form, as errors or omissions can lead to penalties or fines.

Data required when writing the form includes the payer's TIN, the recipient's TIN, and the amount of nonemployee compensation paid during the tax year. Additional documents that may need to be attached include any 1099 forms issued to the recipient, as well as any documentation related to federal income tax withheld.

Practice and use cases for the form include businesses that hire independent contractors or other self-employed individuals, as well as freelancers and other self-employed individuals who receive nonemployee compensation. The form is required by the IRS to ensure that nonemployee compensation is properly reported and taxed.

Strengths of the form include its simplicity and ease of use, while weaknesses may include the potential for errors or omissions in the reporting process. Opportunities for improvement may include the use of digital tools to streamline the reporting process and reduce the potential for errors.

Related and alternative forms may include the IRS Form 1099-MISC, which was previously used to report nonemployee compensation. The main difference between the two forms is that the Form 1099-NEC is used specifically for reporting nonemployee compensation, while the Form 1099-MISC is used for reporting a broader range of payments.

The form affects the future of the participants by ensuring that nonemployee compensation is properly reported and taxed, which can help to avoid penalties and fines from the IRS. The form is submitted to the IRS for review and processing, and is stored in the payer's records for future reference.

How to file Form 1099-NEC

To file a 1099-NEC form, you will need to follow these general steps:

- Gather information: You will need to gather information about your contractors, including their name, address, Social Security number or taxpayer identification number (TIN), and the amount you paid them.

- Obtain the form: You can obtain a copy of the 1099-NEC form from the IRS website or from a tax preparation software program.

- Fill out the form: Fill out the form with the relevant information, including your information as the payer and the contractor's information as the payee.

- Send copies: Send a copy of the 1099-NEC form to the contractor and to the IRS. The deadline for sending the form to the contractor is January 31st, and the deadline for sending the form to the IRS is February 28th (if filing by mail) or March 31st (if filing electronically).

- Keep records: Keep a copy of the 1099-NEC form for your records.

In conclusion, the IRS Form 1099-NEC is a critical document for businesses and self-employed individuals who pay or receive nonemployee compensation. It is important to carefully review the form and provide accurate and complete information to ensure compliance with IRS regulations.