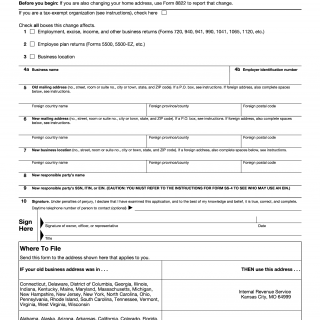

IRS Form 8822-B. Change of Address or Responsible Party

IRS Form 8822-B is used by businesses and organizations to notify the Internal Revenue Service of a change in business mailing address, business location, or responsible party. This form applies to entities that have an Employer Identification Number (EIN).

Purpose of IRS Form 8822-B

The purpose of Form 8822-B is to keep IRS records current for entities with an EIN. It is used to report changes related to where a business receives mail, where it is physically located, or who is identified as the responsible party.

This form is filed separately and is not attached to a tax return.

Who Should File Form 8822-B

Form 8822-B is filed by businesses and organizations that have an EIN, including:

- Corporations

- Partnerships

- Limited liability companies (LLCs)

- Nonprofit and tax-exempt organizations

- Other entities required to maintain EIN records with the IRS

The form applies whether or not the entity is currently engaged in active business operations.

What Information Form 8822-B Updates

Form 8822-B is used to update one or more of the following:

- Business mailing address

- Physical business location

- Identity of the responsible party

Each type of change must be reported accurately based on what information has changed.

Responsible Party Information

Every entity with an EIN must have a responsible party on record with the IRS. If the responsible party changes, Form 8822-B is used to report the updated information.

Responsible party changes are subject to specific reporting requirements outlined in IRS instructions.

What Form 8822-B Does Not Cover

Form 8822-B does not update personal home mailing addresses. Individuals who need to change their personal address with the IRS must use Form 8822 instead.

How Form 8822-B Is Filed

Form 8822-B is filed by mail and should not be attached to a tax return. The completed form is sent to the IRS address listed in the official instructions, based on the entity’s prior address.

Processing Time

After Form 8822-B is received, it generally takes several weeks for the IRS to process the update and reflect the changes in its records.