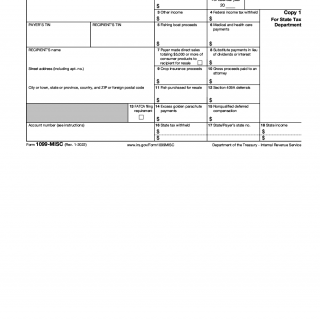

IRS Form 1099-MISC. Miscellaneous Income

IRS Form 1099-MISC is a tax document used to report miscellaneous income earned by individuals or businesses. The purpose of this form is to report income that is not reported on a W-2 form, such as freelance work, contract work, and other types of income.

The form consists of several parts, including the payer's information, the recipient's information, and the income earned. The important fields to consider when writing this form include the recipient's name, address, and tax identification number, as well as the amount of income earned.

The parties involved in this form are the payer and the recipient of the income. It is important to note that the payer is responsible for providing the form to the recipient and to the IRS.

When writing this form, the data required includes the recipient's name, address, and tax identification number, as well as the amount of income earned. Additionally, any expenses incurred in earning the income must be documented and attached to the form.

This form is required for individuals or businesses that pay $600 or more in miscellaneous income to a recipient in a tax year. It is important to file the form with the IRS by the designated deadline to avoid penalties.

One strength of this form is that it helps ensure compliance with tax laws and regulations. However, a weakness is that it can be confusing and difficult to fill out correctly, leading to errors and potential penalties.

An alternative form to the 1099-MISC is the 1099-NEC, which is used to report nonemployee compensation. The main difference between the two forms is the type of income being reported.

Failing to file the form or filing it incorrectly can have serious consequences, including penalties and fines. The form is typically submitted electronically or by mail to the IRS and a copy is provided to the recipient of the income.

In conclusion, IRS Form 1099-MISC is an important tax document used to report miscellaneous income earned by individuals or businesses. It is important to accurately fill out all fields on the form and attach any required documentation. This form helps ensure compliance with tax laws and regulations and is required for anyone who pays $600 or more in miscellaneous income to a recipient in a tax year.