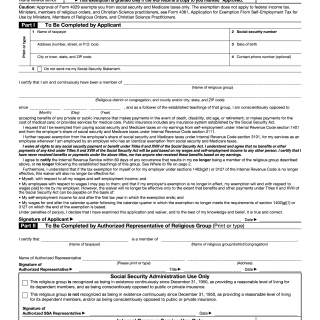

IRS Form 4029. Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits

Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits, is a form used by ministers, members of religious orders, and Christian Science practitioners to request an exemption from paying Social Security and Medicare taxes, as well as to waive their entitlement to benefits under these programs.

The main purpose of this form is to provide an exemption for individuals who, due to their religious beliefs, do not wish to participate in Social Security and Medicare programs. The form consists of several parts, including basic information about the applicant, their religious affiliation, and a certification of their beliefs.

Important fields to consider when filling out this form include the applicant's name, Social Security number, and religious affiliation. Applicants must also provide a detailed statement of their religious beliefs and explain why they object to participating in Social Security and Medicare programs.

Applicants must attach additional documentation, including a letter from their religious organization confirming their affiliation and a statement from their employer confirming that they are a minister, member of a religious order, or Christian Science practitioner.

Examples of situations where this form may be used include ministers who work for a church that does not participate in Social Security and Medicare programs, or members of religious orders who have taken a vow of poverty and do not receive a salary that qualifies for Social Security and Medicare taxes.

Strengths of this form include the ability for individuals to exercise their religious beliefs without penalty, while weaknesses may include a potential loss of benefits in the future. Opportunities may include the ability for individuals to save money on taxes, while threats may include changes to Social Security and Medicare programs that could impact individuals who have waived their entitlement to benefits.

Related forms include Form 4361, which is used by ministers and members of religious orders to request an exemption from Social Security taxes only, and Form 2031, which is used by Christian Science practitioners to request an exemption from Social Security and Medicare taxes only.

Submitting this form can affect the future of the participants by exempting them from paying Social Security and Medicare taxes and waiving their entitlement to benefits under these programs. The form is typically submitted to the Social Security Administration and is kept on file for future reference.