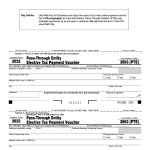

Form FTB-3893. Elective Tax Payment Voucher for Pass-Through Entity

This form is used for making elective tax payments by Pass-Through Entities (PTEs) in California for the taxable year 2023. PTEs include entities like partnerships, limited liability companies (LLCs), and S corporations. The form serves as a voucher for making tax payments to the California tax authorities.