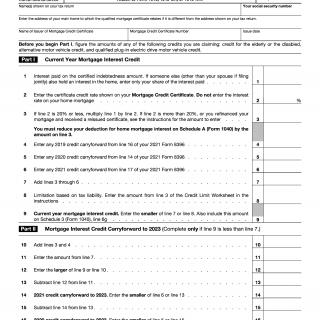

IRS Form 8396. Mortgage Interest Credit

IRS Form 8396, Mortgage Interest Credit, is a form used by taxpayers to claim a credit for a portion of the mortgage interest paid on their home during the tax year. The main purpose of this form is to help homeowners reduce their federal income tax liability.

The form consists of two parts. Part I requires the taxpayer to provide basic information about themselves, their mortgage, and their home. Some of the important fields on this part include the taxpayer's name, social security number, and the amount of mortgage interest paid during the tax year.

Part II of the form is where the taxpayer calculates their credit. This part requires the taxpayer to provide information about their income, the amount of mortgage interest paid, and the credit rate. The credit rate is a percentage determined by the IRS and varies depending on the tax year.

The parties involved in this form are the taxpayer and the IRS. It is important to consider accuracy and completeness when filling out the form to avoid errors and potential audits.

When writing this form, taxpayers will need to have their mortgage statement and other documents that show the amount of mortgage interest paid during the tax year. They may also need to attach additional documents to support their claim.

One strength of this form is that it helps homeowners reduce their federal income tax liability. However, a weakness is that not all taxpayers may qualify for the credit. Opportunities for this form may include encouraging homeownership and supporting the housing industry. A threat related to this form may be potential audits or penalties for inaccurate or incomplete information.

An alternative form to this is Form 1098, which is provided by the mortgage lender and shows the amount of mortgage interest paid during the tax year. The difference is that Form 1098 is used for informational purposes only and does not allow taxpayers to claim the credit.

The completion of this form can have a positive impact on the future of the participants by reducing their federal income tax liability and potentially increasing their disposable income. The form is submitted with the taxpayer's federal income tax return and is stored by the IRS.