IRS Form 7203. S Corporation Shareholder Stock and Debt Basis Limitations

IRS Form 7203 is a form used by S corporation shareholders to calculate the limitations on their stock and debt basis. The primary purpose of this form is to determine the amount of losses and deductions that can be claimed on the shareholder's individual tax return.

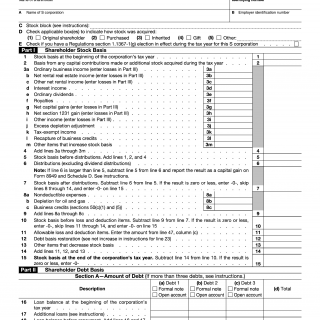

The form consists of several parts, including a section for identifying information about the shareholder and the S corporation, a section for calculating the shareholder's stock basis, and a section for calculating the shareholder's debt basis. The important fields in this form include the shareholder's name and identification number, the S corporation's name and identification number, and the shareholder's stock and debt basis.

The parties involved in the use of this form are the S corporation shareholder and the S corporation. It is important to consider the complexity of the S corporation structure and ensure that all information provided is accurate when writing this form. Data required when writing this form includes the shareholder's name and identification number, the S corporation's name and identification number, and the shareholder's stock and debt basis. No additional documents need to be attached to this form.

An application example of this form is when an S corporation shareholder wants to claim a loss on their individual tax return. The shareholder must first calculate their stock and debt basis limitations using Form 7203 before claiming the loss.

The strengths of this form include its ability to ensure that shareholders accurately calculate their stock and debt basis limitations, which can prevent errors and promote compliance with tax laws. Its weaknesses include its complexity and the potential for errors in reporting. Opportunities for improvement include the use of technology to automate reporting and reduce the likelihood of errors. Threats related to this form include the potential for legal action if basis limitations are not reported accurately.

Alternative forms that could be used in place of Form 7203 include Form 1120S or Schedule K-1. The main difference between these forms is their focus - Form 1120S is used to report the income, deductions, and credits of the S corporation, while Schedule K-1 is used to report the shareholder's share of these items.

The use of Form 7203 can impact the future of the participants in a positive way by promoting compliance with tax laws and avoiding legal action. The form should be submitted along with the shareholder's individual tax return and should be stored in a safe place for future reference.