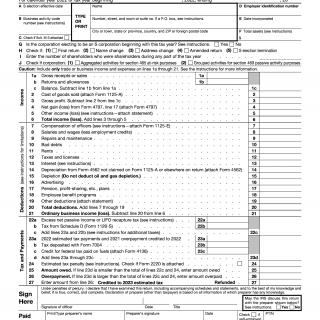

IRS Form 1120-S. U.S. Income Tax Return for an S Corporation

IRS Form 1120-S, U.S. Income Tax Return for an S Corporation is a tax form used by S corporations to report their income, gains, losses, deductions, credits, and other information to the Internal Revenue Service (IRS).

The main purpose of this form is to calculate and report the income tax liability of an S corporation. The form consists of several parts, including a summary of income and deductions, a balance sheet, and schedules for reporting specific types of income or deductions.

Important fields on the form include the corporation's name, address, Employer Identification Number (EIN), and the name and contact information of the person preparing the return. It is important to ensure that all fields are filled out accurately and completely to avoid errors or delays in processing.

Data required when writing the form includes the corporation's income, expenses, assets, and liabilities for the tax year. Additionally, the corporation must provide information on any shareholders, including their names, addresses, and ownership percentages.

Documents that may need to be attached to the form include supporting documentation for expenses, such as receipts or invoices, and schedules for reporting specific types of income or deductions.

An example of an application of this form would be an S corporation filing their annual income tax return with the IRS.

Strengths of this form include its ability to accurately report income and deductions for S corporations and ensure compliance with tax laws. Weaknesses could include the potential for errors or delays in processing. Opportunities for improvement could include the use of technology for more efficient filing and processing. A potential threat could be non-compliance with tax laws or regulations.

An alternative form could be IRS Form 1120, which is used by regular corporations to report their income tax liability. The main difference between the two forms is that S corporations are pass-through entities, meaning that their income and losses are passed through to shareholders and reported on their individual tax returns.

The use of this form affects the future of the S corporation and its shareholders, as compliance with tax laws is necessary for continued operation. The form is typically submitted to the IRS by the S corporation and is stored on file by both the corporation and the IRS.