IRS Form 2290. Heavy Highway Vehicle Use Tax Return

IRS Form 2290 is the official federal tax return used to report and pay the Heavy Highway Vehicle Use Tax for certain heavy vehicles operated on public highways during the applicable tax period.

Purpose of IRS Form 2290

Form 2290 is used within the federal excise tax system to determine whether a heavy highway vehicle is subject to the Heavy Highway Vehicle Use Tax and to calculate the amount of tax due based on the vehicle’s taxable gross weight and period of highway use.

The tax reported on Form 2290 is imposed to support the construction and maintenance of public highways and is administered by the Internal Revenue Service.

Vehicles covered by Form 2290

Form 2290 applies to heavy highway vehicles with a taxable gross weight of 55,000 pounds or more that are registered, or required to be registered, and are used on public highways.

Taxable gross weight is determined under federal rules and generally includes the unloaded weight of the vehicle, the unloaded weight of any trailers customarily used with the vehicle, and the maximum load customarily carried.

Tax period reported on Form 2290

The Heavy Highway Vehicle Use Tax is reported for a fixed annual tax period that runs from July 1 through June 30 of the following year. This tax period does not align with the calendar year.

Form 2290 is filed based on the month a vehicle is first used on public highways during the tax period, which affects both the filing deadline and whether a full or partial period tax applies.

How Form 2290 is used within federal processes

Form 2290 is used in several federal and state-level processes related to the operation and registration of heavy highway vehicles. Filing the form establishes compliance with federal tax requirements applicable to qualifying vehicles.

The information reported on Form 2290 is relied upon by state motor vehicle agencies and other authorities to verify that the federal Heavy Highway Vehicle Use Tax has been properly addressed.

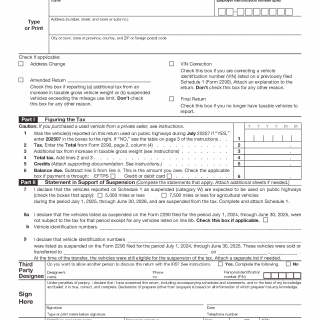

Structure of IRS Form 2290

Form 2290 consists of a main return and supporting schedules that together document the vehicles reported and the tax treatment applied to each vehicle.

Main return

The main portion of Form 2290 is used to calculate the tax based on taxable gross weight categories, determine the total tax due for the period, report credits, and identify whether the return is original, amended, or final.

Statement in support of suspension

The form includes sections used to declare vehicles that are expected to be used only a limited number of miles during the tax period and are therefore reported as suspended from the tax under mileage-based rules.

Schedule 1

Schedule 1 lists each reported vehicle by vehicle identification number and category. After Form 2290 is filed and accepted, Schedule 1 serves as the official record showing which vehicles were reported as taxable or suspended.

Schedule 1 and proof of compliance

Schedule 1 generated from Form 2290 functions as official proof that the Heavy Highway Vehicle Use Tax requirements have been satisfied for the listed vehicles.

This proof is commonly required by state motor vehicle agencies when registering or renewing registration for heavy highway vehicles and may also be requested in other compliance contexts.

Official scenarios addressed by Form 2290

Form 2290 is designed to address a range of official reporting scenarios, including vehicles first used during the tax period, vehicles expected to qualify for mileage-based suspension, increases in taxable gross weight, and changes affecting previously reported vehicles.

The form also accommodates situations where vehicles are sold, destroyed, or otherwise removed from service during the tax period, as reflected in the applicable reporting and credit mechanisms.

Role of Form 2290 in the Heavy Highway Vehicle Use Tax system

Within the Heavy Highway Vehicle Use Tax system, Form 2290 functions as the central reporting document that links vehicle operation, tax liability, and compliance verification.

By consolidating vehicle identification, weight classification, usage period, and tax status, the form provides a standardized method for administering the tax across jurisdictions.

For practical guidance on when Form 2290 is required, how it is filed, and how Schedule 1 is used in real situations, see Form 2290 practical guide.