IRS Form 8865. Return of U.S. Persons With Respect to Certain Foreign Partnerships

IRS Form 8865 is a return used to report information about certain foreign partnerships in which U.S. persons are partners. The primary purpose of this form is to provide the IRS with information about the foreign partnership's income, deductions, and credits, as well as the U.S. person's share of these items.

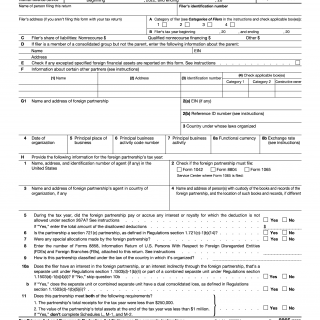

The form consists of several parts, including a section for identifying information about the partnership, a section for reporting income, deductions, and credits, and a section for reporting the U.S. person's share of these items. The important fields in this form include the name and address of the foreign partnership, the U.S. person's identification number, and the U.S. person's share of income, deductions, and credits.

The parties involved in the use of this form are the foreign partnership and the U.S. person who is a partner in the partnership. It is important to consider the complexity of the partnership structure and ensure that all information provided is accurate when writing this form. Data required when writing this form includes the name and address of the foreign partnership, the U.S. person's identification number, and the U.S. person's share of income, deductions, and credits. Additional documents that must be attached include a copy of the partnership agreement and a statement of foreign activities.

An application example of this form is when a U.S. person is a partner in a foreign investment fund and must report their share of the fund's income, deductions, and credits to the IRS. Another example is when a U.S. person is a partner in a foreign business and must report their share of the business's income, deductions, and credits to the IRS.

The strengths of this form include its ability to provide the IRS with important information about foreign partnerships and promote compliance with tax laws. Its weaknesses include its complexity and the potential for errors in reporting. Opportunities for improvement include the use of technology to automate reporting and reduce the likelihood of errors. Threats related to this form include the potential for legal action if information is not reported accurately.

Alternative forms that could be used in place of IRS Form 8865 include IRS Form 5471 or Form 8858. The main difference between these forms is the type of foreign entity being reported - Form 5471 is used to report information about foreign corporations, while Form 8858 is used to report information about foreign disregarded entities.

The use of IRS Form 8865 can impact the future of the participants in a positive way by promoting compliance with tax laws and avoiding legal action. The form should be submitted to the IRS by the due date of the U.S. person's tax return and should be stored in a safe place for future reference.