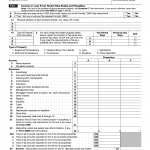

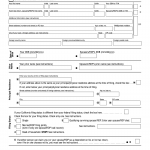

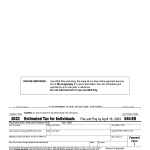

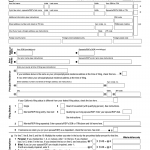

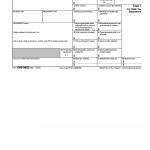

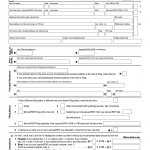

Form 540. California Resident Income Tax Return

The California Resident Income Tax Return, also known as Form 540, is a tax form used by California residents to file their state income tax returns. The main purpose of this form is to report the amount of income earned in California and calculate the appropriate amount of state income tax owed or refund due.