IRS Form 8379. Injured Spouse Allocation

IRS Form 8379, also known as the Injured Spouse Allocation, is used by taxpayers who file a joint tax return with their spouse but have had their portion of the refund withheld to pay their spouse's past-due debts. The main purpose of this form is to claim a portion of the joint tax refund that was offset (withheld) to pay the other spouse's debts.

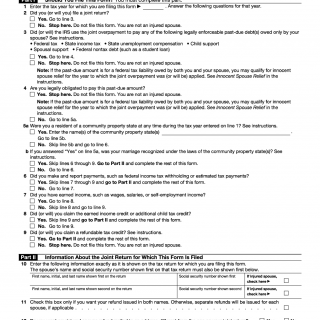

The form consists of several parts, including Part I, which requires the taxpayer to provide their personal information, such as name, address, and social security number. Part II is used to allocate the refund between the injured spouse and the spouse with the past-due debts. The important fields in this part include the amount of the refund, the amount of the past-due debts, and the portion of the refund to be allocated to the injured spouse.

The parties involved in completing this form are the taxpayer and their spouse. It is important to consider that the injured spouse must have reported income on the joint tax return and must not be responsible for the past-due debts. Additionally, the form must be filed separately from the joint tax return and must be filed after the refund has been offset.

When filling out the form, the taxpayer will need to provide their personal information, as well as information about their spouse's past-due debts, such as the type of debt, the agency owed, and the amount owed. Documents that may need to be attached include a copy of the joint tax return, a statement of income, and a statement of expenses.

An example of when to use this form is if a married couple files a joint tax return, but one spouse owes back taxes, child support, or other debts. In this case, the IRS may offset the entire refund to pay the past-due debts, leaving the other spouse with nothing. The injured spouse can use Form 8379 to claim their portion of the refund.

Strengths of this form include the ability to protect the injured spouse's portion of the refund from being used to pay debts they are not responsible for. Weaknesses include the potential for delays in processing the refund and the need to file the form separately from the joint tax return.

Alternative forms include Form 8857, which is used to request innocent spouse relief, and Form 14039, which is used to report identity theft and request a refund. An analogue to this form is Form 8858, which is used by U.S. citizens and resident aliens who own or control a foreign disregarded entity to report certain information.

To fill and submit the form, the taxpayer should complete all required fields, attach any necessary documents, and mail the form to the address listed in the instructions. The form should be stored with the taxpayer's other tax records for at least three years.