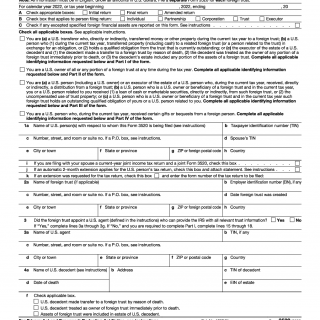

IRS Form 3520. Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts

The IRS Form 3520 is an annual return form that is used to report transactions with foreign trusts and the receipt of certain foreign gifts. The main purpose of this form is to ensure that individuals who have received gifts or inheritances from foreign sources are reporting them correctly to the Internal Revenue Service (IRS).

This form consists of several sections that require important information from the filer, including their personal information, details about the foreign trust or gift, and any income generated from the trust or gift. It is important to note that this form is required for any foreign trust or gift that exceeds a certain value threshold.

When compiling this form, it is important to have all of the necessary information readily available, including the value of the foreign trust or gift, any income generated from it, and any relevant documentation, such as receipts or legal documents related to the trust or gift.

One common application of this form is for individuals who have received significant gifts or inheritances from foreign sources. By submitting this form to the IRS, individuals can ensure that they are reporting their foreign assets correctly and avoiding potential penalties or legal issues.

Strengths of this form include its ability to ensure that individuals are reporting their foreign assets correctly and avoiding potential legal issues. A potential weakness could be the complexity of the form and the need for additional documentation to support the reported information. Opportunities for improvement could include the possibility of simplifying the form or providing more detailed instructions for filers.

An alternative form to the IRS Form 3520 could be the FBAR (Foreign Bank Account Report), which is used to report foreign financial accounts. While both forms are used to report foreign assets, the FBAR is typically used for bank accounts and the IRS Form 3520 is used for foreign trusts and gifts.

The IRS Form 3520 can affect the future of filers by ensuring that they are reporting their foreign assets correctly and avoiding potential legal issues. The completed form is typically submitted to the IRS and a copy should be kept for the filer's records.

In summary, the IRS Form 3520 is an annual return form used to report transactions with foreign trusts and the receipt of certain foreign gifts. It requires important information from the filer and is used to ensure that individuals are reporting their foreign assets correctly to the IRS. While the form can be complex, it can help filers avoid potential legal issues and penalties.