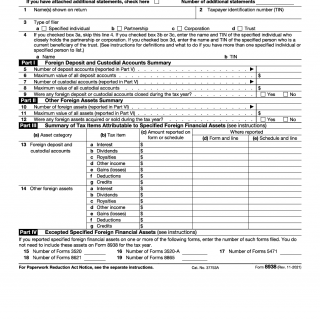

IRS Form 8938. Statement of Specified Foreign Financial Assets

IRS Form 8938, Statement of Specified Foreign Financial Assets, is a tax form used to report specified foreign financial assets and calculate the taxpayer's tax liability. The form is used by U.S. taxpayers who have an interest in specified foreign financial assets, including bank accounts, securities, and other financial instruments.

The form consists of several parts, including Part I, which is used to report the taxpayer's personal information and the type of foreign assets they hold, and Part II, which is used to report the maximum value of the foreign assets during the tax year. Important fields on the form include the name and address of each foreign financial institution where the assets are held, the account number or other identifying information for each asset, and the maximum value of each asset during the tax year.

When compiling the form, it is important to consider the parties involved in the ownership of the foreign assets, as well as any relevant documents that need to be attached, such as account statements or other financial records.

Application examples of the form include reporting foreign bank accounts, foreign stocks and securities, and foreign mutual funds. Practice and use cases include reporting foreign real estate, foreign partnerships, and foreign trusts.

Strengths of the form include its ability to accurately report specified foreign financial assets and ensure compliance with U.S. tax law, while weaknesses include its complexity and the need for accurate documentation and record-keeping.

Related forms include Form 114, Report of Foreign Bank and Financial Accounts (FBAR), and Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts. An alternative form is Form 8938-A, Statement of Specified Foreign Financial Assets by Qualified Intermediaries.

The completion and submission of Form 8938 can affect the future of the parties involved, as it can impact the amount of taxes owed or the penalties assessed for non-compliance.

The completed form is typically submitted to the Internal Revenue Service (IRS), along with any relevant attachments, and a copy is kept for the records of all parties involved.