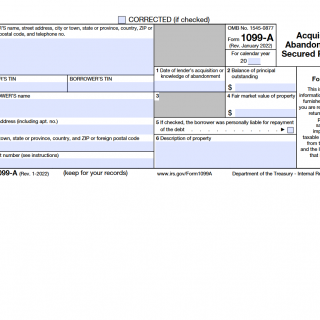

IRS Form 1099-A. Acquisition or Abandonment of Secured Property

IRS Form 1099-A, Acquisition or Abandonment of Secured Property, is a tax form used by lenders and financial institutions to report the acquisition or abandonment of secured property, such as real estate, to the Internal Revenue Service (IRS). This form is important for taxpayers who have had a property foreclosed or repossessed, as it can affect their tax liability.

The form consists of several parts, including the borrower's information, the lender's information, and details about the property. Important fields include the borrower's name, address, and taxpayer identification number (TIN), as well as the lender's name, address, and TIN. Additionally, the form requires information about the property, such as the date of acquisition or abandonment, the fair market value, and the outstanding balance of the mortgage or loan.

When completing the form, it is important to consider the parties involved and ensure that all information is accurate and complete. Taxpayers will need to provide documentation to support any claims made on the form, such as a copy of the foreclosure or repossession notice.

Examples of use cases for Form 1099-A include a lender foreclosing on a property due to nonpayment of a mortgage or a financial institution repossessing a vehicle due to default on a loan. The form can also be used to report the abandonment of property, such as when a borrower walks away from a property and stops making payments.

Strengths of the form include its ability to accurately report the acquisition or abandonment of secured property, which can help taxpayers avoid potential tax penalties. Weaknesses may include the complexity of the form and the need for supporting documentation.

Related forms include IRS Form 1099-C, which reports cancellation of debt, and IRS Form 1099-S, which reports the sale of real estate. Analogues to this form may include state-specific foreclosure or repossession forms.

To fill and submit the form, taxpayers can either use paper forms or file electronically through the IRS website. The completed form should be sent to the IRS and a copy should be provided to the borrower. The form should be stored for at least three years.

In conclusion, IRS Form 1099-A is a tax form used to report the acquisition or abandonment of secured property to the IRS. It consists of several parts, requires important information about the parties involved and the property, and requires supporting documentation. It is important to ensure accuracy and completeness when completing the form, and to consider related forms and filing requirements.