IRS Form 4797. Sales of Business Property

IRS Form 4797, Sales of Business Property, is a tax form used to report the sale of business property and calculate the gain or loss on the sale. The form is used by individuals, partnerships, corporations, and trusts to report the sale of depreciable and non-depreciable business property.

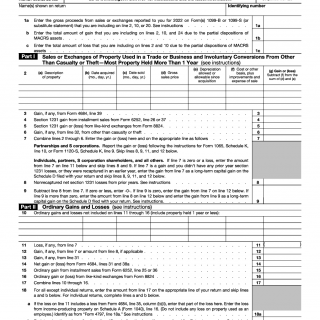

The form consists of several parts, including Part I, which is used to report the sale of depreciable property, and Part II, which is used to report the sale of non-depreciable property. Important fields on the form include the date of sale, the amount realized from the sale, and the adjusted basis of the property.

When compiling the form, it is important to consider the parties involved in the sale of the property, as well as any relevant documents that need to be attached, such as a settlement statement or purchase contract.

Application examples of the form include reporting the sale of a business or rental property, reporting the sale of equipment or vehicles used in a business, and reporting the sale of stock in a small business corporation.

Strengths of the form include its ability to accurately calculate gain or loss on the sale of business property, while weaknesses include its complexity and the need for accurate documentation and record-keeping.

Related forms include Form 8824, Like-Kind Exchanges, and Form 4684, Casualties and Thefts. An alternative form is Form 8949, Sales and Other Dispositions of Capital Assets, which is used to report the sale of all capital assets, including business property.

The completion and submission of Form 4797 can affect the future of the parties involved, as it can impact the amount of taxes owed or the amount of gain or loss recognized on the sale of the property.

The completed form is typically submitted to the Internal Revenue Service (IRS), along with any relevant attachments, and a copy is kept for the records of all parties involved.