Schedule K-1 (Form 1065)

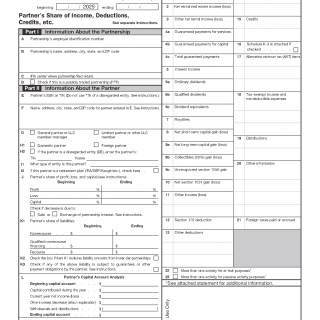

Schedule K-1 (Form 1065) is an official IRS tax form used by partnerships to report each partner’s distributive share of income, deductions, credits, and other tax items for a specific tax year.

This page provides the official blank Schedule K-1 (Form 1065) template and a reference overview of its structure. If you are looking for explanations, filing guidance, or answers to specific situations, see the related guides below.

- Schedule K-1 (Form 1065): Overview and How It Works

- When Do You Receive Schedule K-1?

- Schedule K-1 for LLC Members

Purpose of Schedule K-1 (Form 1065)

Schedule K-1 is used to inform each partner of their share of partnership tax items that must be reported on the partner’s own tax return. Partnerships do not pay federal income tax at the entity level; instead, income and losses are passed through to partners.

A separate Schedule K-1 must be prepared for each partner for each tax year.

Who Receives Schedule K-1

Schedule K-1 (Form 1065) is issued to:

- General partners

- Limited partners

- Members of LLCs treated as partnerships for federal tax purposes

- Partners that are individuals, corporations, trusts, estates, or retirement plans

Structure of Schedule K-1 (Form 1065)

According to IRS instructions, Schedule K-1 consists of three main parts.

Part I — Information About the Partnership

- Partnership name and address

- Employer Identification Number (EIN)

- IRS center where Form 1065 was filed

- Publicly traded partnership (PTP) status, if applicable

Part II — Information About the Partner

- Partner name, address, and taxpayer identification number

- Partner type (general, limited, or LLC member)

- Domestic or foreign partner status

- Partner’s share of profit, loss, and capital

- Partner’s share of liabilities

- Capital account analysis

Part III — Partner’s Share of Income, Deductions, Credits, and Other Items

- Ordinary business income or loss

- Rental real estate and other rental income or loss

- Guaranteed payments

- Interest, dividends, and royalties

- Capital gains and losses

- Credits and alternative minimum tax (AMT) items

- Foreign transactions and taxes

- Distributions and other required information

Tax Year and Filing Context

Schedule K-1 (Form 1065) is issued for a specific tax year and is provided to partners after the partnership prepares Form 1065, U.S. Return of Partnership Income.

For calendar-year partnerships, Schedule K-1 is generally provided by March 15. Partnerships using a fiscal year follow a different schedule based on their tax year end.

Related IRS Forms

- Form 1065 — U.S. Return of Partnership Income

- Schedule K-3 — Partner’s Share of International Activities

- Form 1040 — U.S. Individual Income Tax Return

- Form 1120-S — U.S. Income Tax Return for an S Corporation

Download Schedule K-1 (Form 1065)

The official blank Schedule K-1 (Form 1065) template issued by the Internal Revenue Service is available for download on this page.

If you need guidance on how Schedule K-1 is used, reported, or issued in specific situations, refer to the related guides listed above.