IRS Form 2553. Election by a Small Business Corporation

The IRS Form 2553 is used by small business corporations to elect to be treated as an S corporation for tax purposes. The main purpose of this form is to allow small businesses to take advantage of certain tax benefits that are available to S corporations, such as avoiding double taxation on corporate income.

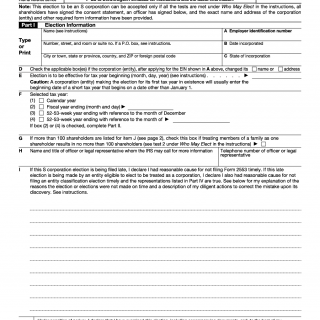

This form consists of several sections that require important information from the filer, including the name and address of the corporation, the date of incorporation, and the names and addresses of all shareholders. It is important to note that this form must be filed within a certain timeframe and that all shareholders must sign the form.

When compiling this form, it is important to have all of the necessary information readily available, including the corporation's tax identification number, the names and addresses of all shareholders, and any relevant legal documents related to the corporation.

One common application of this form is for small businesses that are looking to reduce their tax burden by electing to be treated as an S corporation. By submitting this form to the IRS, small businesses can take advantage of certain tax benefits that are available to S corporations.

Strengths of this form include its ability to help small businesses reduce their tax burden and avoid double taxation on corporate income. A potential weakness could be the complexity of the form and the need for all shareholders to sign the form. Opportunities for improvement could include the possibility of simplifying the form or providing more detailed instructions for filers.

An alternative form to the IRS Form 2553 could be the IRS Form 8832, which is used to change the tax classification of an LLC. While both forms are used to change the tax classification of a business entity, the IRS Form 2553 is specifically for small business corporations and the IRS Form 8832 is for LLCs.

The IRS Form 2553 can affect the future of the participants by allowing small businesses to take advantage of certain tax benefits that are available to S corporations. The completed form is typically submitted to the IRS and a copy should be kept for the corporation's records.

In summary, the IRS Form 2553 is used by small business corporations to elect to be treated as an S corporation for tax purposes. It requires important information from the filer and all shareholders must sign the form. While the form can be complex, it can help small businesses reduce their tax burden and avoid double taxation on corporate income.