IRS Form 8027. Employer's Annual Information Return of Tip Income and Allocated Tips

IRS Form 8027, also known as Employer's Annual Information Return of Tip Income and Allocated Tips, is a tax form used by employers who operate large food or beverage establishments where tipping is customary. The main purpose of the form is to report the amount of tip income received by employees and the amount of allocated tips paid out by the employer.

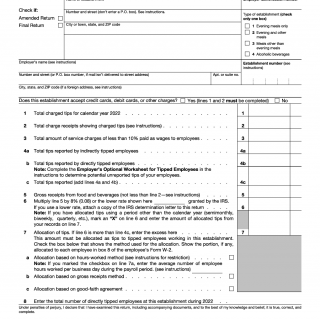

The form consists of several parts, including employer information, establishment information, total gross receipts, total charged tips, and allocated tips. Important fields on the form include the employer's name, address, and employer identification number (EIN), as well as the establishment's name and address. It is important for employers to accurately complete the form, as any errors or omissions can result in potential tax penalties.

The parties involved in the form are the employer and the IRS. The employer is responsible for filling out the form and submitting it to the IRS, while the IRS uses the information on the form to ensure compliance with tax laws related to tip income and allocated tips.

When filling out the form, employers will need to provide information about their establishment's gross receipts and charged tips, as well as the amount of allocated tips paid out to employees. No additional documents need to be attached to the form.

Examples of when an employer may need to fill out a Form 8027 include owning a large food or beverage establishment where tipping is customary, such as a restaurant or bar. The form should be completed annually.

Strengths of the form include its ability to ensure compliance with tax laws related to tip income and allocated tips, while weaknesses include its complexity and potential for errors. Opportunities for improvement include simplifying the form and providing more guidance for employers on how to complete it accurately. Threats related to the form include potential tax penalties for incorrect reporting.

Related forms include Form 1099-MISC, which is used by businesses to report payments made to independent contractors, and Form W-2, which is used by employers to report wages paid to employees. An alternative form to Form 8027 is the IRS Withholding Calculator, which can help employers determine how much federal income tax should be withheld from their employees' paychecks.

To fill out and submit Form 8027, employers should download the form from the IRS website, complete it accurately, and submit it to the IRS by the due date. The form should be stored in a safe place for future reference.