IRS Form 4506. Request for Copy of Tax Return

IRS Form 4506, Request for Copy of Tax Return, is a form used by taxpayers to request a copy of their previously filed tax return. The main purpose of this form is to provide taxpayers with a copy of their tax return for various reasons, such as applying for a loan or mortgage, verifying income, or resolving tax-related disputes.

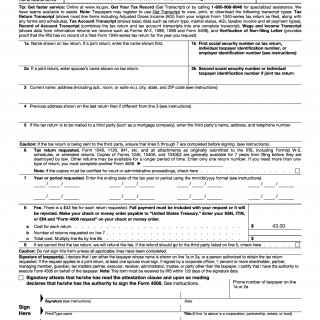

The form consists of one part and important fields include the taxpayer's full name, social security number or taxpayer identification number, tax year or years requested, and reason for the request. The parties involved in this form are the taxpayer and the IRS.

It is important to consider that taxpayers should only request a copy of their tax return if they do not have access to it through other means, such as their tax preparer or tax software. Additionally, taxpayers should be aware that there may be a fee associated with this request.

When filling out this form, taxpayers will be required to provide their personal information, tax return information, and details about their reason for the request. They may also need to attach additional documentation, such as a copy of their government-issued identification or proof of address, depending on the reason for the request.

An example of a use case for this form is if a taxpayer needs a copy of their tax return to apply for a loan or mortgage. They can use Form 4506 to request a copy of their tax return for the relevant tax year.

Strengths of this form include its effectiveness in providing taxpayers with a copy of their previously filed tax return for various purposes. However, a weakness of this form is that there may be a fee associated with the request, and it may take some time for the IRS to process the request and provide the requested copy.

Related forms include Form 4506-T, Request for Transcript of Tax Return, and Form 8821, Tax Information Authorization. An alternative form is Form 4506-A, Request for Public Inspection or Copy of Exempt or Political Organization IRS Form.

To fill and submit this form, taxpayers should follow the instructions provided on the form itself and ensure that they include all required information and documentation. The completed form can be submitted by mail or fax to the appropriate IRS office, as indicated on the form. Taxpayers should keep a copy of the form for their records. The request will be stored in the IRS system for future reference.