IRS Form 3800. General Business Credit

IRS Form 3800, General Business Credit, is a document used by businesses to calculate and claim various tax credits that they are eligible for. The main purpose of this form is to allow businesses to reduce their tax liability by claiming tax credits.

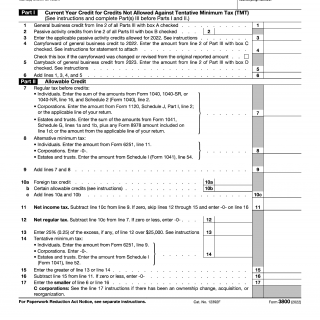

The form consists of three parts. Part I requires the business to provide basic information about the tax year and the credits being claimed. Part II requires the business to calculate the total general business credit. Part III requires the business to provide information about specific credits being claimed, including the investment tax credit, the work opportunity credit, and the disabled access credit.

Important fields to consider when compiling/filling out the form include the credits being claimed, the calculation of the total general business credit, and the documentation required to support the claimed credits. The parties involved in the process include the business and the IRS.

When completing the form, the business will need to provide information about the various tax credits they are claiming, including the amount and type of credit. Additionally, the business must attach any necessary documentation to support their claimed credits.

Application examples and use cases for this form include situations where a business is eligible for various tax credits, such as the research and development credit, the low-income housing credit, and the renewable energy credit. The form is important because it allows businesses to reduce their tax liability and reinvest those savings back into their business.

Strengths of this form include its ability to provide businesses with numerous tax credit options and the potential for significant tax savings. Weaknesses may include the complexity of the form and the need for extensive documentation to support the claimed credits.

Related forms include Form 6765, Credit for Increasing Research Activities, and Form 8820, Orphan Drug Credit. Alternative forms may include state-specific tax forms for claiming tax credits.

Completing and submitting Form 3800 will affect the future tax liability of the business. Once the form is processed, the business's tax liability will be reduced by the amount of the claimed tax credits. The form is submitted to the IRS and is stored in their database.

In conclusion, IRS Form 3800 is an important document for businesses that are eligible for various tax credits. Accurately completing and submitting this form ensures that the business can claim tax credits and reduce their tax liability.