IRS Form 2555. Foreign Earned Income

IRS Form 2555, Foreign Earned Income, is a document used by U.S. citizens or residents who work and earn income abroad to claim the foreign earned income exclusion on their U.S. tax return. The main purpose of this form is to allow taxpayers to exclude a certain amount of their foreign earned income from U.S. taxation.

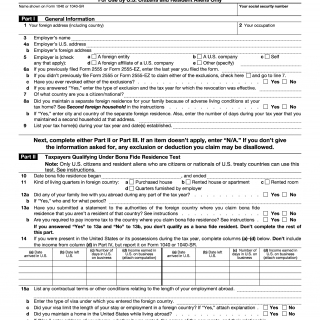

The form consists of four parts. Part I requires the taxpayer to provide basic information about their identity, tax year, and foreign residency. Part II requires the taxpayer to calculate their foreign earned income exclusion. Part III requires the taxpayer to provide information about their foreign housing expenses. Part IV requires the taxpayer to provide additional information about their foreign residency, including the physical presence test or bona fide residence test.

Important fields to consider when compiling/filling out the form include the foreign earned income exclusion amount, foreign residency information, and foreign housing expenses. The parties involved in the process include the taxpayer and the IRS.

When completing the form, the taxpayer will need to provide information about their foreign earned income, foreign residency, and foreign housing expenses. Additionally, the taxpayer must attach a statement explaining their qualifying facts and circumstances.

Application examples and use cases for this form include situations where a U.S. citizen or resident works and earns income abroad, such as expatriates, missionaries, and military personnel. The form is important because it allows taxpayers to reduce their U.S. tax liability and avoid double taxation.

Strengths of this form include its simplicity and the fact that it provides a clear process for claiming the foreign earned income exclusion. Weaknesses may include the need for additional documentation and potential delays in processing.

Related forms include Form 1116, Foreign Tax Credit, and Form 8938, Statement of Foreign Financial Assets. Alternative forms may include state-specific tax forms for reporting foreign income.

Completing and submitting Form 2555 will affect the future tax liability of the taxpayer. Once the form is processed, the taxpayer's foreign earned income exclusion will be recognized, and they will be able to reduce their U.S. tax liability. The form is submitted to the IRS and is stored in their database.

In conclusion, IRS Form 2555 is an important document for U.S. citizens or residents who work and earn income abroad. Accurately completing and submitting this form ensures that the taxpayer can claim the foreign earned income exclusion and reduce their U.S. tax liability.