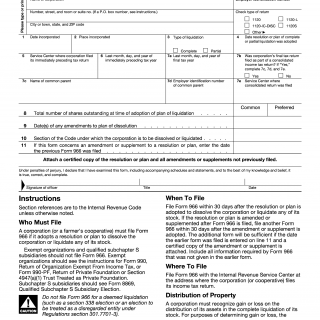

IRS Form 966. Corporate Dissolution or Liquidation

IRS Form 966, Corporate Dissolution or Liquidation, is a document used by corporations to inform the IRS about their plans to dissolve or liquidate their business. The main purpose of this form is to give notice to the IRS that a corporation is ceasing operations and to request the IRS to recognize the termination of the corporation's existence as a legal entity.

The form consists of two parts. Part I requires the corporation to provide basic information about the business, such as the legal name, address, and EIN. Part II requires the corporation to provide information regarding the dissolution or liquidation, including the date of the resolution to dissolve or liquidate, the date operations ceased, and the distribution of assets.

Important fields to consider when compiling/filling out the form include the effective date of the dissolution or liquidation, the distribution of assets, and the reason for the dissolution or liquidation. The parties involved in the process include the corporation and the IRS.

When completing the form, the corporation will need to provide information about the distribution of assets, including the fair market value of any property distributed. Additionally, the corporation must attach a copy of the resolution authorizing the dissolution or liquidation.

Application examples and use cases for this form include situations where a corporation is closing down due to financial difficulties, a change in business strategy, or a merger or acquisition. The form is important because it ensures that the corporation is no longer subject to taxes, and it protects the shareholders and directors from future legal liabilities.

Strengths of this form include its simplicity and the fact that it provides a clear process for dissolving or liquidating a corporation. Weaknesses may include the need for additional documentation and potential delays in processing.

Related forms include Form 1120, U.S. Corporation Income Tax Return, and Form 966-A, Dissolution or Liquidation of a Subsidiary. Alternative forms may include state-specific dissolution or liquidation forms.

Completing and submitting Form 966 will affect the future of the corporation and its shareholders. Once the form is processed, the corporation will no longer be subject to taxes or legal liabilities. The form is submitted to the IRS and is stored in their database.

In conclusion, IRS Form 966 is an important document for corporations that are dissolving or liquidating their business. Accurately completing and submitting this form ensures that the corporation is no longer subject to taxes or legal liabilities and protects the shareholders and directors from future legal issues.