IRS Form W-4R. Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions

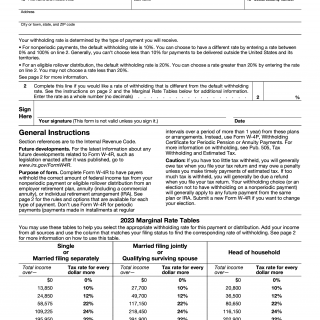

The W-4R, Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions, is a form used by individuals who receive nonperiodic payments or eligible rollover distributions and want to adjust the amount of federal income tax withheld from those payments. The main purpose of this form is to determine the amount of federal income tax to be withheld from these payments.

The form consists of several parts, including personal information about the recipient, details about the nonperiodic payments or eligible rollover distributions, and certification by the recipient. The important fields to consider when compiling/filling out this form include the recipient's name, address, and social security number, as well as the amount of the nonperiodic payments or eligible rollover distributions.

The parties involved in the completion of this form include the recipient and the payer of the nonperiodic payments or eligible rollover distributions. It is important to consider the tax implications of adjusting the federal income tax withholding on these payments and to consult with a tax professional before submitting the form.

When compiling/filling out this form, the recipient will need to provide their personal information and the details of the nonperiodic payments or eligible rollover distributions. Additionally, the recipient may need to attach supporting documents, such as a statement from the payer of the nonperiodic payments or eligible rollover distributions.

Examples of when this form may be needed include when an individual receives a lump sum payment from a retirement plan or when an individual receives a distribution from an IRA. The strengths of this form include the ability to adjust the amount of federal income tax withheld from nonperiodic payments or eligible rollover distributions. The weaknesses of this form include the potential for errors in calculating the appropriate amount of federal income tax to be withheld.

Related forms include the W-4, Employee's Withholding Certificate, which is used by employees to adjust the amount of federal income tax withheld from their wages. Alternative forms include the W-4P, Withholding Certificate for Pension or Annuity Payments, which is used by recipients of pension or annuity payments to adjust the amount of federal income tax withheld from those payments.

The completion of this form can affect the future of the recipient by adjusting the amount of federal income tax withheld from nonperiodic payments or eligible rollover distributions. The form is submitted to the payer of the nonperiodic payments or eligible rollover distributions and stored in their records.