IRS Form 8919. Uncollected Social Security and Medicare Tax on Wages

The IRS Form 8919, Uncollected Social Security and Medicare Tax on Wages, is a form used by taxpayers to report and pay Social Security and Medicare taxes that were not withheld from their wages. The main purpose of this form is to calculate and report the amount of uncollected Social Security and Medicare taxes owed by the taxpayer.

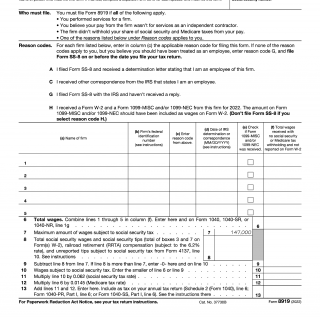

The form consists of several parts, including the taxpayer's personal information, the employer's information, and a calculation of the uncollected taxes owed. Important fields that must be filled out include the taxpayer's name, address, Social Security number, and the amount of uncollected taxes owed.

When filling out the form, data such as the employer's name and address, the taxpayer's wages, and the amount of uncollected taxes owed will be required. Additionally, supporting documents such as pay stubs and W-2 forms may need to be attached.

The parties involved in this form are the taxpayer and the Internal Revenue Service (IRS). It is important to consider the accuracy of the information provided on the form to ensure that the correct amount of taxes owed is reported and paid.

Application examples and practice and use cases for the IRS Form 8919 include taxpayers who have not had the correct amount of Social Security and Medicare taxes withheld from their wages. The form can help calculate and report the amount of uncollected taxes owed and avoid penalties and interest for underpayment.

One strength of the IRS Form 8919 is that it allows taxpayers to report and pay uncollected Social Security and Medicare taxes and avoid penalties and interest for underpayment. A weakness is that it requires careful attention to detail and adherence to IRS regulations, which can be time-consuming and confusing for some taxpayers.

Alternative forms or analogues to the IRS Form 8919 may include the IRS Form 941, which is used to report payroll taxes withheld from employee wages, and the IRS Form W-4, which is used to determine the amount of taxes to be withheld from employee wages. The main difference between these forms is the specific information that is recorded and the purpose for which the information is used.

Submitting the IRS Form 8919 can be done through the Internal Revenue Service (IRS) or through tax preparation software. The form should be stored in a safe and secure location for future reference. The successful completion and submission of the IRS Form 8919 can help ensure that taxpayers are properly reporting and paying Social Security and Medicare taxes on their wages.