IRS Form 433-F. Collection Information Statement

IRS Form 433-F, Collection Information Statement, is a form used by individuals who owe taxes to the IRS and need to provide detailed information about their financial situation to the IRS. The main purpose of this form is to determine the taxpayer's ability to pay their tax debt and to set up a payment plan if necessary.

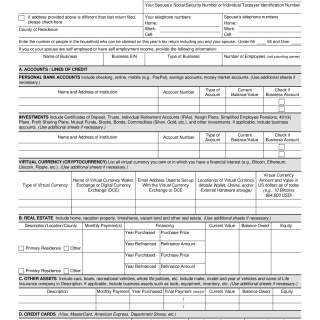

The form consists of several parts that include basic information about the taxpayer, their employment status, income, expenses, assets, and liabilities. The important fields to consider when compiling/filling out the form include the taxpayer's name, address, social security number, and employer information. Other important fields include the taxpayer's income, expenses, and assets, as well as their bank account information.

The parties involved in this form include the taxpayer and the IRS. It is important to consider that the information provided on this form will be used to determine the taxpayer's ability to pay their tax debt and to set up a payment plan. Therefore, accuracy is crucial when compiling/filling out the form.

When compiling/filling out the form, the taxpayer will need to provide detailed information about their financial situation, including their income, expenses, assets, and liabilities. Additionally, they may need to attach supporting documents such as bank statements, pay stubs, and tax returns.

Application examples and use cases for this form include individuals who owe taxes to the IRS and are unable to pay their tax debt in full. By completing this form, they can provide the IRS with the necessary information to determine their ability to pay and to set up a payment plan if necessary.

Strengths of this form include its ability to help taxpayers who are unable to pay their tax debt in full to set up a payment plan. Weaknesses of this form include the potential for the taxpayer to provide inaccurate or incomplete information, which could lead to legal issues and consequences.

Related forms include Form 433-A and Form 433-B, which are similar to Form 433-F but are used for different types of taxpayers. Form 433-A is used for wage earners and self-employed individuals, while Form 433-B is used for businesses.

The form affects the future of the participants by providing the IRS with the necessary information to determine their ability to pay their tax debt and to set up a payment plan if necessary. If the taxpayer provides accurate and complete information on the form, they may be able to avoid legal issues and consequences.

The form is submitted to the IRS and stored in their database. It is important to keep a copy of the form for your records.