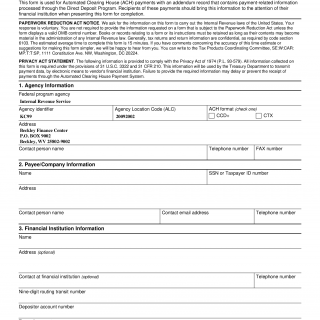

IRS Form 3881. ACH Vendor/Miscellaneous Payment Enrollment

IRS Form 3881, also known as the ACH Vendor/Miscellaneous Payment Enrollment, is a form used by vendors and contractors to enroll in the Automated Clearing House (ACH) payment system to receive payments from the United States government.

This form consists of several parts, including basic information about the vendor or contractor, banking information, and authorization for the government to initiate ACH payments from their account. The form requires accurate and complete information to avoid delays or errors in payments.

The parties involved in the use of this form include the vendor or contractor, the United States government agency making the payments, and the financial institutions involved in the transfer of funds. The use of this form can affect the future of the participants by ensuring that payments are received in a timely and efficient manner, avoiding delays and penalties.

When writing this form, vendors and contractors will need to provide their basic information, such as their name, address, and Taxpayer Identification Number (TIN), as well as their banking information, including their account and routing numbers. They may also need to attach additional documents, such as a voided check or bank letter, to verify their banking information.

Examples of application and use cases for this form include vendors and contractors who provide goods or services to the United States government and wish to receive payment through the ACH system.

Strengths of this form include its efficiency in processing payments and reducing the risk of errors or delays. Weaknesses may include the need for accurate and complete information to avoid issues with payments. Opportunities for improvement may include simplifying the form or providing additional resources for vendors and contractors to complete the form accurately.

Alternative forms or analogues to this form may include paper checks or wire transfers, which may be less efficient or more costly than ACH payments. The main difference between this form and other payment methods is the use of the ACH system for electronic transfers of funds.

The ACH Vendor/Miscellaneous Payment Enrollment form can be submitted online through the System for Award Management (SAM) website or by mail. The form is stored in government records for a period of time.