IRS Form 433-D. Installment Agreement

IRS Form 433-D, Installment Agreement, is a form used by individuals who owe taxes to the Internal Revenue Service (IRS) and want to set up a payment plan to pay off their tax debt over time. The main purpose of this form is to establish an installment agreement between the taxpayer and the IRS.

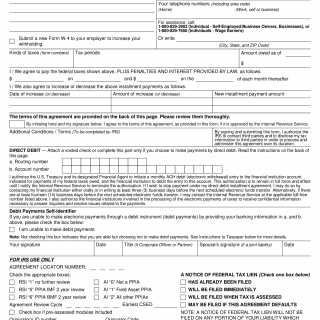

The form consists of several parts, including personal information about the taxpayer, details about the tax debt owed, and certification by the taxpayer. The important fields to consider when compiling/filling out this form include the taxpayer's name, address, and social security number, as well as the amount of the tax debt owed and the proposed monthly payment amount.

The parties involved in the completion of this form include the taxpayer and the IRS. It is important to consider the terms of the installment agreement, including the proposed monthly payment amount and the length of the payment plan, before submitting the form. The IRS may request additional financial information to determine the taxpayer's ability to pay.

When compiling/filling out this form, the taxpayer will need to provide their personal information and the details of the tax debt owed. Additionally, the taxpayer may need to attach supporting documents, such as a copy of their most recent tax return and proof of income.

Examples of when this form may be needed include when an individual owes taxes to the IRS but is unable to pay the full amount owed at once. The strengths of this form include the ability to establish a payment plan that fits the taxpayer's budget and the potential to avoid more severe collection actions by the IRS. The weaknesses of this form include the potential for additional fees and interest on the tax debt owed.

Related forms include Form 9465, Installment Agreement Request, which is used to request an installment agreement with the IRS, and Form 433-F, Collection Information Statement, which is used to provide the IRS with information about the taxpayer's financial situation. An analogue of this form is a personal loan agreement between a borrower and a lender, which establishes a payment plan for the repayment of a loan.

The completion of this form can affect the future of the taxpayer by allowing them to pay off their tax debt over time and avoid more severe collection actions by the IRS. The form is submitted to the IRS and stored in their records.