IRS Form 8300. Report of Cash Payments Over $10,000 Received In a Trade or Business

IRS Form 8300 is a report used to disclose cash payments received over $10,000 in a trade or business. The primary purpose of this form is to prevent money laundering and tax evasion by tracking large cash transactions.

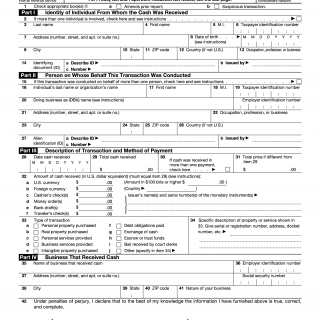

The form consists of several parts, including a section for identifying information about the business and the individual making the payment, a section for the payment details, and a certification statement. The important fields in this form include the name and address of the business, the name and address of the individual making the payment, and the amount of the payment.

The parties involved in the use of this form are the business receiving the cash payment and the individual making the payment. It is important to consider the legality of the transaction and ensure that all information provided is accurate when writing this form. Data required when writing this form includes the name and address of the business, the name and address of the individual making the payment, and the amount of the payment. No additional documents need to be attached to this form.

An application example of this form is when a car dealership receives a cash payment of $15,000 for a vehicle purchase. Another example is when a jewelry store receives a cash payment of $11,000 for a high-end piece of jewelry.

The strengths of this form include its ability to prevent money laundering and tax evasion, while its weaknesses include the possibility of false reporting or underreporting of cash payments. Opportunities for improvement include the use of technology to automate reporting and reduce the likelihood of errors. Threats related to this form include the potential for legal action if cash payments are not reported accurately.

Alternative forms that could be used in place of IRS Form 8300 include a bank deposit slip or a sales receipt. The main difference between these forms is their level of detail - a bank deposit slip only provides information about the amount of the deposit, while a sales receipt only provides information about the item purchased.

The use of IRS Form 8300 can impact the future of the participants in a positive way by promoting transparency and compliance with tax laws. The form should be submitted to the IRS within 15 days of receiving the cash payment and should be stored in a safe place for future reference.