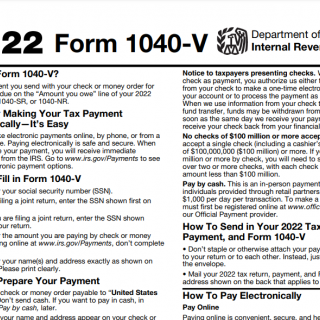

IRS Form 1040-V. Payment Voucher

Form 1040-V, also known as the Payment Voucher, is a form used by taxpayers to accompany their payments when they file their tax returns. It is not a tax return itself, but rather a voucher that is used to ensure that the payment is credited to the correct tax account.

The form consists of only one part, and the only field that must be completed is the payment amount. Other fields include the taxpayer's name, address, and Social Security Number or Taxpayer Identification Number.

This form is typically used when a taxpayer is submitting a payment with their tax return, or when they are making a payment for an extension of time to file their tax return.

The parties involved in this document are the taxpayer and the IRS.

When filling out the form, it is important to ensure that the payment amount is accurate and that the form is signed and dated.

The main advantage of using Form 1040-V is that it helps ensure that the payment is credited to the correct tax account. This can help avoid penalties and interest charges that may be assessed if the payment is not properly credited.

One potential problem that can arise when filling out the form is if the payment amount is incorrect or if the form is not signed or dated properly. This can result in the payment not being credited to the correct tax account, which can lead to penalties and interest charges.

Related forms include Form 1040, which is the main tax return form, and Form 4868, which is used to request an extension of time to file a tax return. An alternative form to Form 1040-V is to make a payment electronically using the IRS's Direct Pay system.

Form 1040-V can be submitted along with the taxpayer's tax return or payment, and the form and payment are typically mailed to the appropriate IRS address. Copies of the form should be kept for the taxpayer's records.