Verification of Non-Filing Letter

A Verification of Non-Filing Letter is a document issued by the Internal Revenue Service (IRS) to confirm that an individual or entity did not file a tax return for a specific tax year. This letter is usually required when applying for financial aid or other government assistance programs that require proof of non-filing.

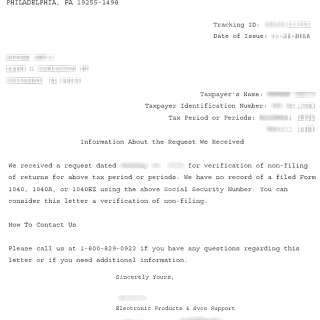

The Verification of Non-Filing Letter includes the name, Social Security number or Employer Identification Number, and the tax year(s) for which the individual or entity did not file a tax return. The letter also includes the date that the IRS received the request for the Verification of Non-Filing Letter.

It's important to note that a Verification of Non-Filing Letter is not proof of income or tax liability. It simply confirms that the individual or entity did not file a tax return for the specified tax year(s). If an individual or entity did file a tax return, the IRS will issue a transcript of the tax return instead of a Verification of Non-Filing Letter.

To request a Verification of Non-Filing Letter, an individual or entity can complete and submit Form 4506-T, Request for Transcript of Tax Return, to the IRS. Alternatively, the individual or entity can call the IRS toll-free number at 1-800-908-9946 and follow the automated prompts to request a Verification of Non-Filing Letter.

Some cases where a Verification of Non-Filing Letter may be necessary:

- Financial Aid Application: When applying for financial aid for college, a Verification of Non-Filing Letter may be required as proof that the student or their parents did not file a tax return for the previous year.

- Government Assistance Programs: Many government assistance programs, such as Medicaid or food stamps, require applicants to provide proof of income or proof of non-filing. A Verification of Non-Filing Letter may be required to prove that the applicant did not file a tax return for the specified tax year.

- Loan Applications: When applying for a loan, such as a mortgage or personal loan, a lender may require a Verification of Non-Filing Letter to verify the applicant's income and tax status.

- Job Application: Employers may require a Verification of Non-Filing Letter as part of the hiring process to verify an applicant's tax status and eligibility to work in the United States.

- Identity Verification: A Verification of Non-Filing Letter may be required as part of an identity verification process, such as when applying for a passport or driver's license.

In general, a Verification of Non-Filing Letter may be required whenever an individual or entity needs to prove that they did not file a tax return for a specified tax year. It's important to note that the specific requirements for obtaining a Verification of Non-Filing Letter may vary depending on the organization or entity requesting the letter.