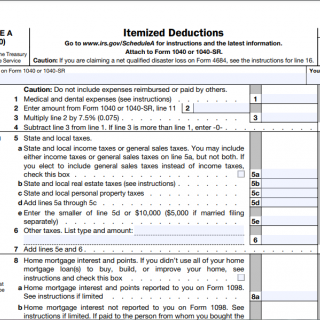

IRS Form 1040 Schedule A. Itemized Deductions

Form 1040 Schedule A is an IRS form used by taxpayers who want to itemize their deductions on their tax return. This form is used to report various deductions that can be claimed by taxpayers, such as medical expenses, state and local taxes, mortgage interest, charitable contributions, and more.

The form consists of seven parts, each of which relates to a different type of deduction. These parts are:

- Medical and Dental Expenses

- Taxes You Paid

- Interest You Paid

- Gifts to Charity

- Casualty and Theft Losses

- Job Expenses and Certain Miscellaneous Deductions

- Other Miscellaneous Deductions

The most important fields on this form are the ones that relate to the specific deductions being claimed. For example, if a taxpayer is claiming a deduction for mortgage interest, they would need to provide information about the amount of interest paid during the tax year, as well as the name and address of the lender.

This form is compiled by taxpayers who want to itemize their deductions rather than taking the standard deduction. The parties to the document are the taxpayer and the IRS.