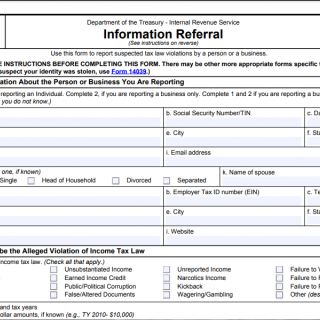

IRS Form 3949a. Information Referral

IRS Form 3949a is a document used to report suspected tax fraud or evasion to the Internal Revenue Service (IRS) in the United States. This form is used to report individuals or businesses that are suspected of not complying with tax laws or committing tax fraud.

The form consists of several parts, including the personal information of the person reporting the fraud, the name and address of the suspected party, and a detailed description of the suspected fraud or evasion. The most important fields are those that provide information about the suspected fraud or evasion, including the type of tax involved, the amount of money involved, and any evidence or documentation that supports the suspicion.

This form is typically compiled by individuals or businesses that suspect that another party is committing tax fraud or evasion. The parties to the document are the person reporting the fraud and the suspected party. It is important to note that the person reporting the fraud may choose to remain anonymous if they wish.

When compiling this form, it is important to ensure that all information provided is accurate and supported by evidence or documentation. Any false or misleading information could potentially result in legal consequences.

The advantages of this form are that it provides a way for individuals or businesses to report suspected tax fraud or evasion, which helps to ensure that everyone is complying with tax laws and regulations. This helps to maintain the integrity of the tax system and ensure that everyone pays their fair share.

However, there can be problems when filling out this form, such as providing inaccurate or incomplete information, or misinterpreting the tax laws or regulations. It is important to seek professional advice or guidance if there are any questions or concerns about filling out this form.

How to submit Form 3949-A

This form can be submitted to the IRS online, by mail, or by fax. Once submitted, the IRS will review the form and any supporting documentation and determine whether further action is necessary. Instances of this form are stored in the IRS's database for future reference and investigation.

To send in your completed form by mail, you'll need to print it out and mail it to the following address:

Internal Revenue Service PO Box 3801 Ogden, UT 84409

Alternatively, you can also submit Form 3949-A online using the IRS's website. To do so, follow these steps:

- Visit the Digital Mailroom Referral Submission website at https://apps.irs.gov/app/digital-mailroom/referrals/

- Click on the "Get Started" button.

- Provide your contact information, including your name, address, phone number, and email address.

- Provide information about the individual or organization that you are reporting, including their name, address, and Social Security number or Employer Identification Number (if known).

- Provide detailed information about the suspected tax fraud or misconduct, including any relevant dates, amounts, and supporting documentation.

- Submit your completed form.

It's important to note that submitting Form 3949-A does not guarantee that an investigation will be launched, but it does provide the IRS with valuable information that may assist them in identifying potentially fraudulent activities.