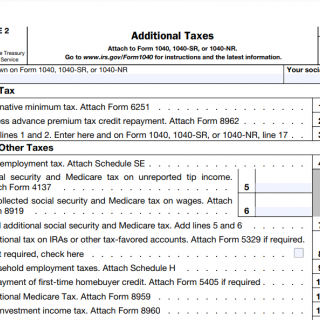

IRS Form 1040 Schedule 2. Additional Taxes

IRS Form 1040 Schedule 2 is an additional tax form used in the United States to report additional taxes owed that cannot be entered directly on Form 1040. This form is used by taxpayers who owe additional taxes beyond what was paid through withholding or estimated tax payments.

The form consists of several parts, including sections for reporting additional taxes owed, such as self-employment tax or the Additional Medicare Tax, and sections for reporting certain other taxes, such as the Net Investment Income Tax. The most important fields on this form are those that report the additional taxes owed, as these can have a significant impact on the taxpayer's overall tax liability.

This form is typically compiled by taxpayers who owe additional taxes beyond what was paid through withholding or estimated tax payments. The parties to the document are the taxpayer and the IRS.

When compiling this form, it is important to ensure that all information provided is accurate and complete. Any false or misleading information could potentially result in penalties or legal consequences. Taxpayers should gather all relevant documentation related to the additional taxes owed before starting to fill out the form.

The advantages of this form are that it provides a way for taxpayers to report additional taxes owed that cannot be entered directly on Form 1040, and it can help to ensure that taxpayers are paying the correct amount of taxes.

However, there can be problems when filling out this form, such as providing inaccurate or incomplete information, or failing to report all additional taxes owed. It is important to seek professional advice or guidance if there are any questions or concerns about filling out this form.

This form is typically submitted along with Form 1040 when filing federal income taxes. It can be submitted electronically or by mail. Once submitted, the IRS will review the form and any supporting documentation and determine the taxpayer's overall tax liability. Instances of this form are stored in the IRS's database for future reference and investigation.