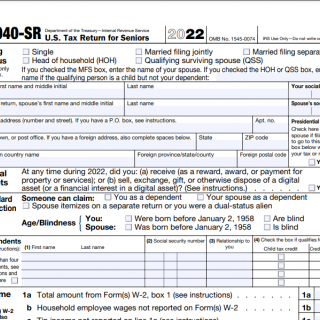

IRS Form 1040 SR. Tax Return for Seniors

Form 1040 SR is an IRS form used by taxpayers who are 65 or older or who have a disability to report their income and deductions. This form is a simplified version of the regular Form 1040 and is intended to make it easier for older taxpayers and those with disabilities to file their taxes.

The form consists of several parts, including:

- Part I: General Information

- Part II: Income

- Part III: Adjustments to Income

- Part IV: Tax and Credits

- Part V: Other Taxes

- Part VI: Payments

- Part VII: Refund or Amount You Owe

The most important fields on this form are those related to income, adjustments to income, and tax and credits. Taxpayers must provide detailed information about their income, including wages, salaries, and tips, as well as any other sources of income, such as pensions or Social Security benefits. They must also provide information about any adjustments to income, such as contributions to an IRA or deductions for student loan interest.

This form is compiled by taxpayers who are 65 or older or who have a disability and who wish to use a simplified version of the Form 1040. The parties to the document are the taxpayer and the IRS.

When compiling this form, it is important to carefully review all the instructions and guidelines provided by the IRS. Taxpayers should make sure that they have all the necessary documentation to support their claims for deductions.

The advantages of using Form 1040 SR are that it provides a simplified way for older taxpayers and those with disabilities to file their taxes, which can help to reduce the burden of tax preparation. It also provides a way for these taxpayers to claim tax deductions related to their income and expenses.

One of the main problems that can arise when filling out this form is making errors or mistakes in calculating income and deductions. This can lead to underpayment of taxes or even penalties for filing an incorrect return.

Some related forms to Form 1040 SR include Form 1040-ES for estimating tax payments and Form 1040-V for submitting payments with a tax return. An alternative form to Form 1040 SR is the regular Form 1040, which is used by most taxpayers to file their taxes.

Form 1040 SR should be submitted along with the taxpayer's Form 1040 tax return. The completed form should be mailed to the appropriate IRS processing center based on the taxpayer's location. A copy of the form should be kept for the taxpayer's records.