IRS Form 1040. U.S. Individual Income Tax Return

IRS Form 1040, U.S. Individual Income Tax Return, is a document used by U.S. taxpayers to report their annual income to the Internal Revenue Service (IRS). The main purpose of this form is to calculate and pay the correct amount of federal income tax owed to the government.

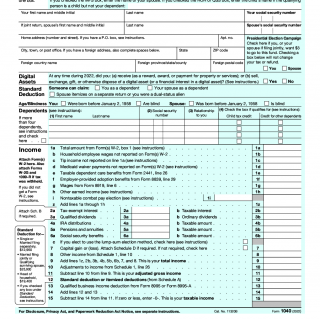

The form consists of several parts, including personal information, income, deductions, and credits. Important fields to consider when compiling the form include gross income, adjusted gross income, taxable income, and total tax liability. Parties involved in the form include the taxpayer, their spouse (if applicable), and any dependents claimed on the return.

When compiling the form, data such as W-2 and 1099 income statements, investment income, and information about deductions and credits will be required. Additional documents that may need to be attached include schedules for itemized deductions, self-employment income, and foreign assets.

Application examples and use cases for Form 1040 include filing as a single taxpayer, married filing jointly, or head of household. Strengths of the form include its flexibility in allowing for various types of income, deductions, and credits. Weaknesses include its complexity and the potential for errors.

Related and alternative forms to consider include Form 1040A and Form 1040EZ, which are simplified versions of the form for those with less complex tax situations. Differences between the forms include eligibility requirements and limitations on income, deductions, and credits.

Filing Form 1040 can have an impact on a taxpayer's future, as it can affect their eligibility for certain tax credits and deductions, as well as their overall tax liability. The form is submitted to the IRS by mail or electronically, and copies should be kept for at least three years after the due date of the return.

File Form 1040 or 1040-SR by April 18, 2023. The due date is April 18, instead of April 15, because of the Emancipa- tion Day holiday in the District of Columbia – even if you don’t live in the District of Columbia. If you file after this date, you may have to pay interest and penalties.

The mailing address for IRS Form 1040 depends on the state and filing status of the taxpayer. Generally, taxpayers should mail their Form 1040 to the IRS address listed on the form. However, taxpayers can also find the correct mailing address for their Form 1040 on the IRS website. Additionally, taxpayers can use the IRS's Where to File tool to find the correct mailing address for their Form 1040.